CHINA’S CONTROL OF RARE EARTH materials was always going to be a problem. Now, as China tightens controls over the rare-earth materials without which vital magnets simply cannot be built, component manufacturers are scrambling to find alternate sources of supply.

There have been numerous warnings that the rare earths situation could become more substantial than the semiconductor shortage that wiped millions of cars from production forecasts between 2021 and 2023, and of the COVID-19 pandemic that closed factories for weeks in 2020. According to reports from the United States and Europe, automotive manufacturers are prioritising backup supplies for key components and re-examining the use of just in-time inventories as the situation intensifies. Automotive News has reported, “the fate of automakers’ assembly lines has been left to a small team of Chinese bureaucrats”.

China controls up to 70 percent of global rare-earth mining, 85 percent of refining capacity, and around 90 percent of rare-earth metal alloys and magnet production. The ongoing trade war with the United States has caused a major bottleneck in supply.

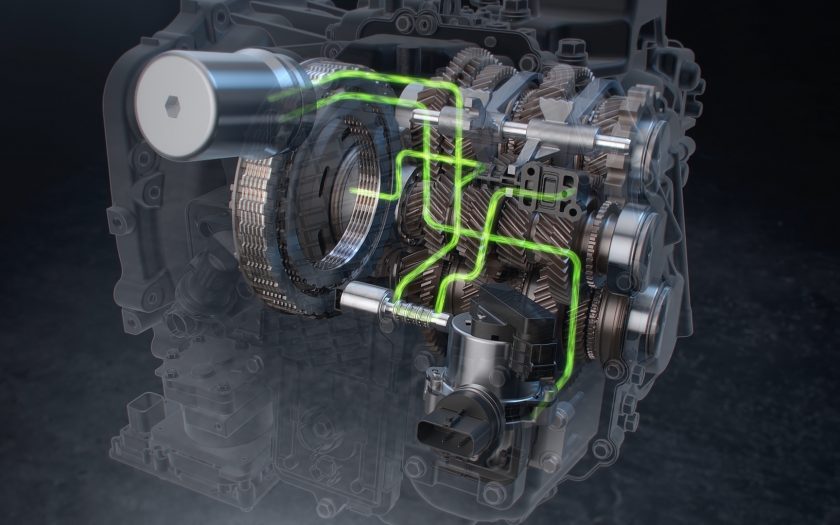

The average electric vehicle uses around 500g of rare-earth elements and the average internal combustion vehicle half that. Rare earth elements are found in components critical to the operation of electric motors, oil pumps, speakers, and a range of sensors and solenoids.